Unlike other delivery methods, the CMAR contracts include a right-to-audit clause that allows many school districts to go through the process to ensure that all savings have been returned to the district.

Understanding and identifying risks in construction contracts may seem like a daunting task. Let’s face it, the contracts are long, the applications for payment are quite convoluted and well, sometimes it seems like we’re trying to decipher a foreign language. Construction Manager At-Risk (CMAR) is a delivery method used by many school districts in Texas and around the United States. Unlike other delivery methods, the CMAR contracts include a right-to-audit clause that allows many school districts to go through the process to ensure that all savings have been returned to the district.

When we’re asked to perform an audit or agreed-upon procedures at the end of a construction project, we start by reviewing the executed contract in order to identify risks and determine our procedures. The latest pay application is also critical. Some may think that we’re looking to make sure that the district paid the pay application on time and is following its accounts payable procedures. However, during this process, we’re ensuring that the contractor’s accounting records support the figures presented on the pay application and that the district was billed in accordance with the contract.

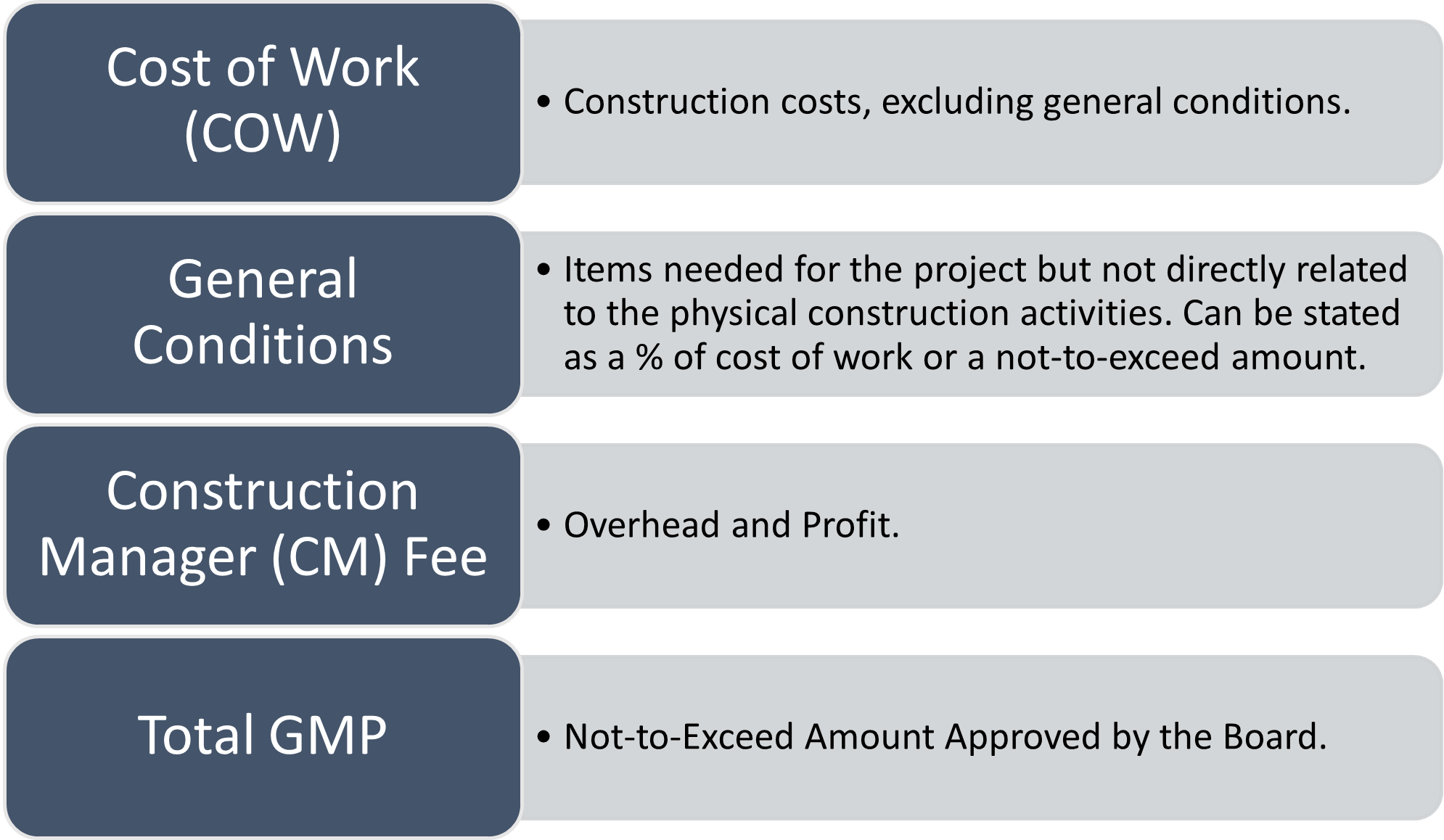

At that the beginning and end of our procedures, we categorize the costs that make up the Guaranteed Maximum Price (GMP) into three major categories: (1) Cost of Work (COW); (2) General Conditions and (3) Construction Manager (CM) Fee.

This process is necessary because we need to reflect on how the construction project was supposed to be billed. This allows us to compare how it was billed and determine if the costs within the contractor’s accounting records support the actual pay application.

As alluded to above, the CMAR delivery method requires that GMP savings are returned to the district. For example, if the GMP is $15,000,000, but the total costs incurred by the contractor, including the CM Fee, is less than the GMP, the Contractor cannot charge the District the entire $15,000,000. Instead, a deductive change order is issued by the Contractor. This is quite different from other delivery methods.

Districts should be aware of contract and pay application pitfalls as they work through a CMAR construction project. Those are described below:

- The COW included in the GMP calculation submitted by the Contractor during the GMP approval phase should not include any general conditions items as COW. Closely review the list of general conditions previously submitted by the Contractor to ensure that none of those items are submitted as COW in the development of the GMP submitted for approval. We’ve seen this before, but luckily the exhibit listing the general conditions was referenced in the contract. Why does this happen? Most of the time the contractor’s overruns are caused by general conditions.

- General conditions should be stated as not-to-exceed amounts or as a percentage of COW. There are times when contractors may request payment for general conditions in excess of the stated amount or percentage. Districts should adhere to the terms of the contract. Payments made to the contractor for circumstances not covered by the contract make it more difficult to audit and for attorneys to defend.

- When the general conditions category is explicitly stated as a not-to-exceed amount, the Contractor does not have the ability to exceed the stated amount even if the total costs of the project are under the GMP. In other words, any savings realized in COW cannot offset overruns in general conditions. These two categories are separate.

- When the contract doesn’t allow the Contractor to realize a CM Fee on self-performed work, ensure that the CM Fee calculation is correct. That is, the Contractor must subtract all self-performed work when calculating the CM Fee. Make sure that the Contractor has disclosed any subsidiaries and related parties. Depending on how the contract is written, work performed by a subsidiary or related party constitutes self-performed work.

- During the contract development phase, make sure that any warranty costs are addressed. At times, contractors will bill the district for a warranty reserve based on percentage of revenue calculation and historical data. In other instances, contractors only include an estimate in the pay application. If your district encounters the latter, rest assured that the contract requires that all amounts billed to the district be accompanied by supporting documentation. Estimates, such as the warranty reserve, without proper supporting documentation are considered a questioned cost that will be additional savings to the district.

- District project managers should pay close attention and periodically make notes of what they observe during the construction phase. Such notes would assist the auditor when questionable items are selected for testing. This could include the number of supervisory personnel on the project. The contract typically will list the number of supervisory personnel that will be assigned to the construction project, and some contracts will even provide the names of the personnel. Deviations from the contract should be noted because it will assist the auditor during their test work. The same goes for equipment that is used during the project. It will also be helpful to the auditor if the project manager pays close attention to the types and quantity of equipment or vehicles used during the project. If the auditor questions certain equipment or vehicles, the district will be able to confirm whether an item was used. In the past, our sample included golf carts. When we asked the project manager if golf carts were seen during the project, the were able to tell us that golf carts were never on site.

- Finally, verbal agreements (or even agreements via email) between the district and the Contractor should be avoided. We as auditors/accountants cannot audit verbal agreements. Remember that the contract is the basis for the financial procedures performed by auditors and a district’s attorneys will always reference the provisions of the contract when evaluating a specific scenario.

As you can see the CMAR delivery method is quite complex. However, there is no need to worry. There are extremely talented school district attorneys that specialize in these types of construction contracts and are can take you through the process step by step. I would recommend that districts have very direct conversations with their contractors at the onset of the project. I think setting the initial expectation (i.e. the construction project will be audited) is important. This may include bringing in your auditor at the beginning of the project to meet with district personnel and the Contractor to discuss the expected procedures. This way, the Contractor knows exactly what type of supporting documentation will be needed and it reduces the number of questioned costs or disagreements that may arise from the audit or agreed-upon procedures.