Awareness of the red flags is the key to mitigate fraud risk. Designing internal controls and ensuring those controls are operating as intended, are critical to limit the opportunity to commit fraud.

Fraud is a very interesting topic so long as it stays out of your organization. Sometimes we think to ourselves “wow, that’s a horrible story, but that would never happen at my school district.” However, it’s more common than we think and that’s a scary thought. According to the Association of Certified Fraud Examiners (ACFE) 2020 Report to the Nation on Occupational Fraud and Abuse (2020 ACFE Study) based on the type of organization, 70% of frauds occurred in private and public companies with a median loss of $150,000. Government entities and nonprofit organizations accounted for 16% and 9% of fraud causes and suffered median loss of $100,000 and $75,000, respectively.

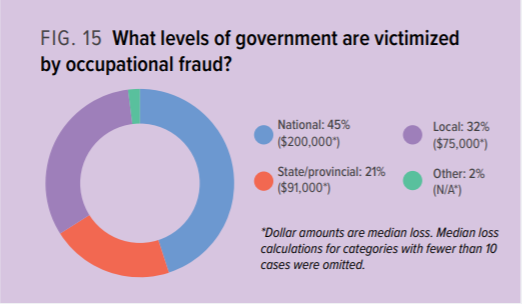

The impact of fraud to different levels of government is based on the available resources and operations. Based on the 2020 ACFE Study, national-level government entities have the greatest number of fraud cases (45%) and highest median loss of $200,000 which is more than twice as much as the number of frauds and median loss at state/provincial level (21% and $91,000). Local governments experience the second-highest number of cases (32%) with a relatively lower median loss of $75,000.

Source: Report to the Nations 2020 Global Study on Occupational Fraud and Abuse

2020-Report-to-the-Nations.pdf (acfepublic.s3-us-west-2.amazonaws.com)

ACFE Fighting Fraud in the Government publication defines government fraud as intentional acts designed to deprive the government of funds by deception or other unfair means. Government is necessary for the stability of a civilized society and promotion of common good for the citizens. Fraudulent acts against government organizations are damaging not only to the government but also to taxpayers and beneficiaries of government programs. Government entities are required to be transparent since they are doing the public’s business. The source of government funds comes primarily from the taxes paid by the individuals and businesses. Therefore, transparency is necessary for government spending and accountability. Materiality does not apply to fraud and once fraud is caught, it will be exposed in the news and other types of social media.

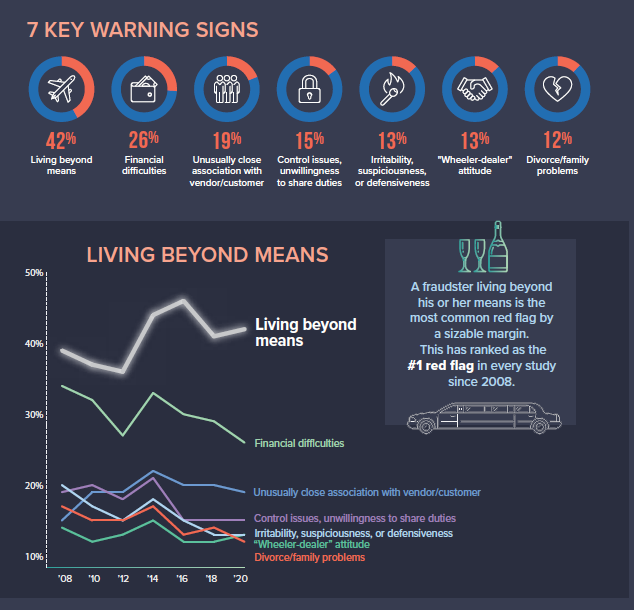

As business managers, we need to be able to identify common red flags and patterns for fraud. We don’t want to become paranoid but being able to identify risky behavior could help organizations detect fraud and prevent or at least lessen losses. According to the 2020 ACFE Study, 85% of all fraudsters displayed at least one behavioral red flag while committing their crimes.

The seven key warning signs are:

- Living beyond means

- Financial difficulties

- Unusually close association with vendor/customer

- Control issues, unwillingness to share duties

- Irritability, suspiciousness, or defensiveness

- “Wheeler-dealer” attitude

- Divorce/family problems

Source: Report to the Nations 2020 Global Study on Occupational Fraud and Abuse

2020-Report-to-the-Nations.pdf (acfepublic.s3-us-west-2.amazonaws.com)

I think a Chief Financial Officer’s worst nightmare is discovering that their superintendent is committing fraud. The crime described below didn’t happen in Texas, but it is horrific enough to give us pause. This story is about a larceny scandal committed by Dr. Frank Tassone. He’s described by the New York Times as a once-adored superintendent of one of Long Island’s best school systems. (https://www.nytimes.com/2006/10/11/nyregion/former-schools-chief-of-roslyn-gets-4-to-12-years-in-fraud.html). Dr. Tassone and his cohorts were living beyond their means until it all came crashing down on them. Dr. Tassone was convicted for $2.2 million spent on luxury vacations, gambling junkets, fees for his Upper East Side apartment, dry cleaning bills, and a vacation home. In April 2020, HBO released Bad Education, a dramatized film based on the events of Tassone’s scandal, starring Hugh Jackman as the disgraced superintendent.

Financial difficulties include pressures such as medical debt and unforeseen financial circumstances. An individual may internally rationalize the necessity to commit fraud to overcome financial pressures.

Government entities have forms and policy in place to determine conflict of interest and related party transactions. Close relationship of those charged with governance or employees with vendors opens the opportunities for contract fraud, kickbacks, bribery, procurement fraud, and fictitious transactions.

Employees who resist sharing control over a financial function or a client relationship exhibit suspicious behavior. They may refuse to train others within the organization in case of an emergency or may be reluctant to take holidays and/or time off for fear of their fraud being discovered while they are away. Some of the workaholic employees who never take vacations are more likely to be fraudsters disguised as dedicated employees. Mandatory vacation policies and job rotation are recommended for fraud deterrent purpose.

Employees who are excessively aggressive or defensive when challenged may also indicate that they are protecting themselves from getting caught.

A “Wheeler-dealer” attitude means a person’s demeanor is characterized by shrewd and unscrupulous behavior. This type of person excuses his or her actions through a sense of entitlement and disdain. This is a red flag that this person thinks that her or she deserves more than what the organization is giving him or her.

Divorce or family problems can be included in financial difficulties as an employee going through a difficult personal struggle may feel external pressure to commit fraud.

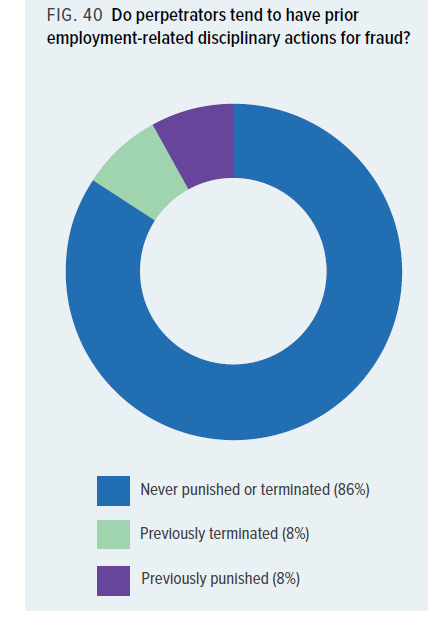

As reflected in the 2020 ACFE Study, 86 percent of fraudsters in the 2020 ACFE study had never been punished or terminated for fraud-related conduct before committing the crimes. Fingerprinting may identify previous crimes, but not necessarily the crimes committed that went unreported or undetected. Awareness of the red flags is the key to mitigate fraud risk. Finally, designing internal controls and ensuring those controls are operating as intended, are critical to limit the opportunity to commit fraud.

Source: Report to the Nations 2020 Global Study on Occupational Fraud and Abuse

2020-Report-to-the-Nations.pdf (acfepublic.s3-us-west-2.amazonaws.com)