don't forget that TEA has added an indicator into FIRST requiring you to discuss the impact of property value changes with your board

As you work through the budget process this year, don't forget that TEA has added an indicator into FIRST requiring you to discuss the impact of property value changes with your board. The indicator language is as follows:

Did the school board members discuss the district's property values and the funding lag at a board meeting within 120 days of the district adopting its budget? (If the school district fails indicator 20 the maximum points and highest rating that the school district may receive is 89 points, B = Above Standard Achievement.)

You will want to document that you have had this conversation by either placing it on the board agenda or maintaining some documented evidence such as placing information in the board book you use in a budget workshop in case you are ever asked to demonstrate compliance.

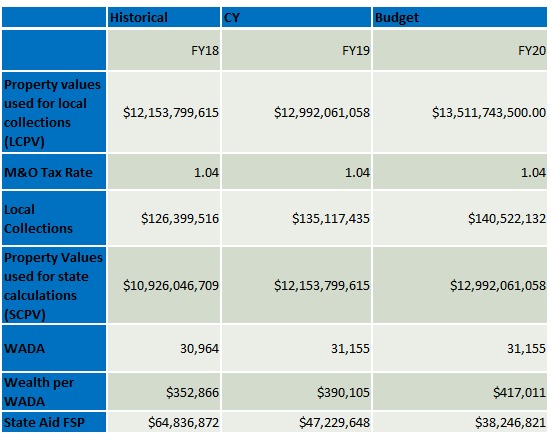

TEA has not prescribed a format that you must use to meet the indicator, but they have provided some tables that you may use if they are helpful. One way to go about having the conversation is to show your board a table that includes historical local taxes, property values, and state aid to demonstrate that revenue varies year by year depending on the rate of property value growth. You can show them the local value, the state funding value, the local property tax collections, and FSP state aid each year to remind them that the state funding value lags the local value by a year. Here is a hypothetical example you could use:

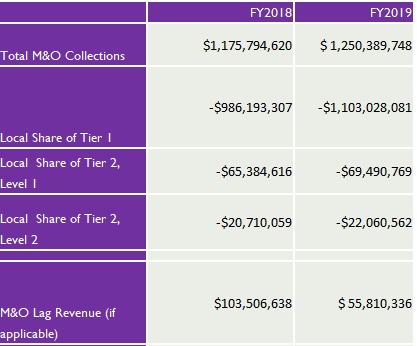

Another option is to quantify the benefit (or loss) associated with using the lagged property value for state aid and recapture purposes. You could show them the difference between the local share of tier 1 and tier 2 and your local property tax collections, thus quantifying the lag. This table provides an example of what that might look like:

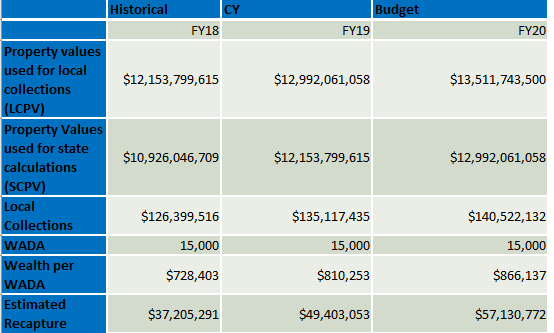

For a chapter 41 district, the following table may be helpful

Each district is different, and property value changes impact each district differently. You will want to modify these tables as necessary to help your school board understand how property value changes impact available revenue in your district so they can make thoughtful long-term spending decisions that protect the fiscal health of the district.3 comments 301 views