Now is a good time to discuss the requirements for each data code included in the new J-4 schedule, as TEA will require it to be submitted as part of the data feed file.

What was just recommended, for 2021 fiscal year ends, is now required for 2022 fiscal year ends. The Schedule J-4 for the most part appears to be simple and straight-forward. However, as with all new things, some questions can often arise. Many districts are feverishly working to finalize their June 30, 2022 financial reports and others are just ramping up their August 31, 2022 financial report preparation. I found it a fitting time to discuss the requirements for each data code included in this new schedule, as it will be required to be submitted as part of the data feed file.

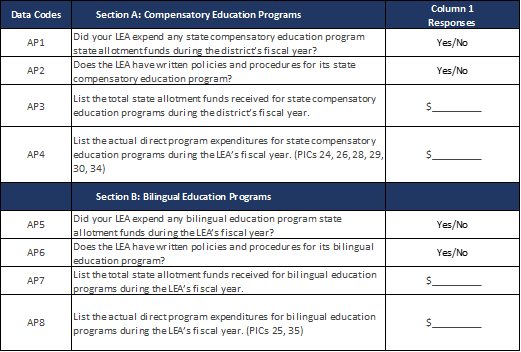

The schedule is comprised of two major sections, Section A: Compensatory Education Programs, and Section B: Bilingual Education Programs. For each section the same 4 questions are asked:

(AP1 and AP5) Does the Local Education Agency (LEA) expend state allotment funds during the fiscal year for each program? (Y/N)

This one is pretty self-explanatory…Did the LEA receive Compensatory Education Allotment and/or Bilingual Education Allotment? Yes or no.

(AP2 and AP6) Does the LEA have written policies and procedures over each program? (Y/N)

Another simple yes or no question? Not really, as this question requires considerably more work to be performed before it can be answered accurately.

LEAs should expect their auditors to request to review the District’s written policies and procedures for each program. During this process, the auditors should thoroughly review the statutory compliance of the LEAs policies and procedures and perform any necessary audit procedures to verify that the LEA is adhering to the provided policy and procedures. An auditor may determine that a detailed test of transactions is necessary, and requests to review a sample of actual direct program expenditures.

Ultimately, this review process is to provide assurance that the LEA has fully implemented their written policies and procedures and that the policies and procedures are in alignment with the statutes summarized below:

- For State Compensatory Education:

- If the LEA is utilizing the Campus Improvement Plans or District improvement plans or the LEA has a local eligibility criterion adopted by the board of trustees, these plans should be reviewed to verify if they include the components outlined in the FASRG Module 6, §6.2.2.

- The methodologies used in identifying eligible students and exiting students aligns with FASRG Module 6 guidance.

- FASRG: Module 6 (texas.gov)

- For Bilingual Education:

- If the LEAs methodologies used for the identification, assessment, and classification of student enrollment in bilingual education programs to determine whether they comply with the TEC, §29.056.

- Texas Education Code Section 29.056 - Enrollment of Students in Program (public.law)

(AP3 and AP7) Total state allotment funds received for each program.

The key to answering this question correctly is making sure you use the correct Summary of Finance (SOF) Run.

- For both June 30th and August 31st year ends, use the Near-Final Allotments Run ID #37791 from September 8, 2022.

- This is the final run before the allotments were adjusted for the additional hold-harmless allotments were made by the State. This is intended to avoid “penalizing” districts and allow LEAs to utilize the lower allotment amounts to assess their compliance with the spending requirements..

- Also, this is the appropriate SOF run when analyzing your State program intent code (PIC) spending requirements.

(AP4 and AP8) Actual Direct Expenditures for each program.

LEAs should only report actual direct unallocated expenditures. Meaning, no PIC 99 allocation or ESSER Funds (Funds 266, 281, 282,) should be included in this figure.

- ESSER Funds and PIC 99 are still allowed for overall compliance with spending requirements, but not for the J-4.

- For bilingual education programs, be sure not to include salaries in PIC 25, unless it’s for class size reduction.

The LEAs responses to these 8 questions will be used to determine if the program funds were not used in compliance with the statutes. The J-4 is intended to help LEAs and auditors focus on the overall compliance with laws and regulations associated with each allotment. The J-4 should not be confused with spending requirements compliance.

In brief, if you received state allotment funding for either of these programs:

- Be sure you have adequate policies and procedures that align with FASRG Module 6, Section 6.2.2 (State Compensatory Education) and TEC, §29.056 (Bilingual Education).

- Use the correct SOF Run

- Only report unallocated actual direct expenditures