The key to successfully receiving FEMA funds is planning for the unexpected, being organized and maintaining clear and concise records.

The Federal Emergency Management Agency, better known as FEMA, provides assistance in times of disaster. The funds are helpful during a time when there is both great uncertainty and obstacles to overcome, either from weather related disasters, human causes, or most recently – a pandemic.

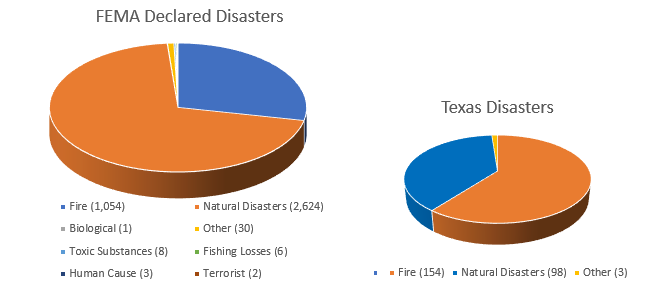

To further illustrate magnitude of work that FEMA handles, there have been 3,728 individual disaster declarations since 1953 with the following make-up:

** Data referenced from FEMA’s Disaster Declaration Summaries (located here)

If you have ever had to work with FEMA from a receiving standpoint or an audit standpoint (performing or preparing for), I am sure that you are aware of the complex nature of navigating the system. This is no surprise given the amount of funds that get distributed, the number of entities that receive funds and how quickly many of the decisions have to be made regarding those funds due to the nature of a declared disaster. You can’t plan for FEMA public assistance grants or take weeks to prepare an application, review information, etc. as you do with most grants. Instead, you are asking for reimbursement for expenditures that you have incurred quickly or determining what costs you incurred that meet the requirements of the award. Despite the complexity of the grants and the urgency of many of the associated expenditures, there are ways to prepare for these emergencies in order to receive FEMA funding.

Many of the key points to help you manage compliance with FEMA guidelines go hand in hand with any disaster recovery plan that you should have in place.

Maintenance of Records:

You should designate someone in your organization’s business or finance office to be responsible for the maintenance of expenditures. You should also set-up an account or organization code that will allow you to record your potential claimed expenditures and communicate this to your organization, specifically to those with the ability to purchase or order goods and services. Ensure records are accessible. One thing COVID-19 has taught us is that electronic recordkeeping can be a lifesaver. Having all invoices scanned in and attached to the expenditure in the system can make the retrieval and preparation of your claims requests more efficient and will ensure that they are accessible even if you are unable to obtain the physical copies. Proper maintenance of records is key in requesting reimbursement and being audit ready, both from FEMA and your external auditors. FEMA reimbursements are requested through project worksheets. Each project worksheet will need the appropriate records attached. As part of your process, when including expenditures for reimbursement, your organization should ensure expenditures are reasonable and necessary, and are authorized under the scope of the work. We know this may seem excessive, but it is crucial to designate and deploy a few employees to take photos of the effects of any disaster almost immediately. Then, you should immediately organize your records by location.

Your external auditors will need to sample expenditures. In order to do this, your records will need to include a detail listing of invoices and payroll charges by employee. These detailed listings will need to be reconciled to the project worksheets. For payroll expenditures, make sure you are following your local policy. If you plan to pay for overtime, FEMA will review all your existing local policies.

Additionally, your external auditors will need to document your controls and procedures over the expenditures that you will be requesting reimbursement for. Having documented procedures can help this process and will help your organization follow the procedures going forward.

Emergency situations do not eliminate the need to follow federal procurement guidelines:

For many areas in Texas, even though natural disasters happen quickly, within your area – you likely know what natural disasters typically occur in your area. Items such as generators, food supplies, transportation, etc. can be planned for ahead of time by establishing vendors you can use as soon as an emergency is imminent. Identifying vendors in a purchasing cooperative that you belong to or bidding them out on an annual basis before the disaster, will allow you to be ready when they are needed. Make sure you are familiar with the meaning of “Exigency” and “Emergency”. Exigent circumstances represent those actions that are required to protect lives and property at the immediate outset of an emergency event. Once the exigent circumstances have passed, procurement should be performed for the remaining needs that you expect to request reimbursement for.

Avoid duplication of benefits – understand your insurance coverage:

Maintaining sufficient insurance coverage is important. When you request reimbursement from insurance, you’ll need to make sure that you offset the correct costs to ensure you don’t duplicate reimbursements from FEMA and insurance. FEMA will need to see your insurance records with your reimbursement requests.

The key to successfully receiving FEMA funds is planning for the unexpected, being organized and maintaining clear and concise records. Emergency expenditures should be tracked through a set of account codes set-up for the specific disaster. Communicate within your organization as to what is allowable and who the point of contact is for questions.