To maintain operations and take advantage of opportunities as they arise, school districts of all sizes should pay particular attention to five areas of business operations.

For small and medium-sized school districts in Texas, adapting business operations in response to COVID-19 can be particularly challenging. With limited staff and resources, managing a remote workforce and maintaining systems can be difficult. To maintain operations and take advantage of opportunities as they arise, school districts of all sizes should pay particular attention to these areas:

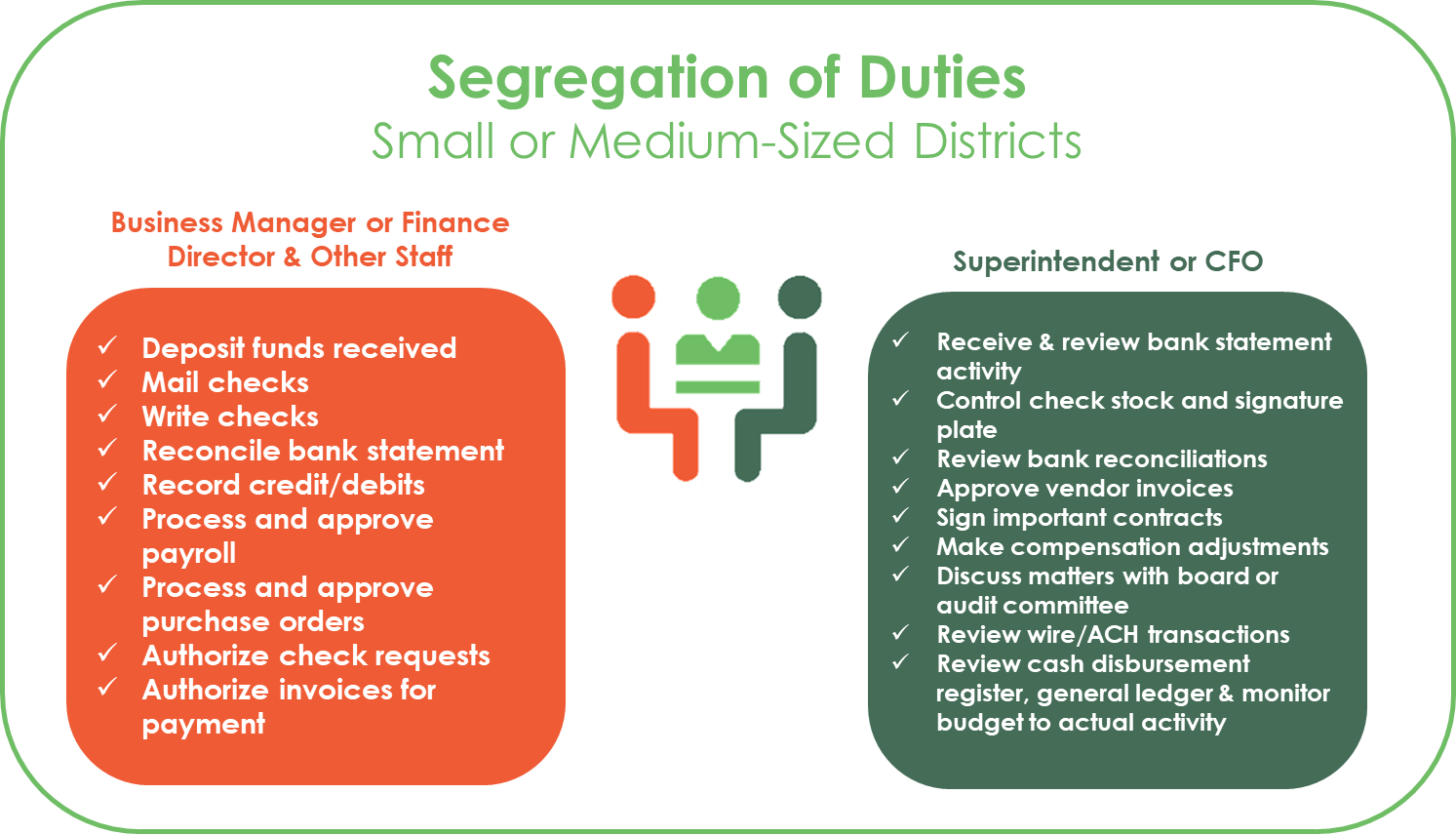

- Maintain segregation of duties. Review your processes to make sure you have the right systems in place to ensure strong internal controls. Your staff may be working remotely, approving invoices and payments from disparate locations. It’s important to maintain segregation of duties and other financial controls as transactions are being processed remotely. In a smaller district, you may need to increase the role of the superintendent or another administrator in order to achieve this goal.

- Ensure transparency and accuracy. Transparency and accuracy of the district’s current financial status is essential during this pandemic. Keep your board aware of additional costs being incurred and abreast of any budget amendments, contract changes, or other matters that may need to be considered or approved. To minimize surprises regarding the district’s fund balance, provide board members with accurate financial reports highlighting the effects COVID-19.

- Monitor expenditures and reimbursements. As additional sources of federal, state and local funding become available as a result of the COVID-19 crisis, it becomes even more important to track costs and make sure data is readily available for reimbursement. With so many new sources of funding coming into play, it is not yet clear what the reporting and tracking requirements will be. As guidance becomes available, TEA, OMB, and TASBO will be important resources to find out which costs are reimbursable and how to report them. Districts may consider tracking COVID-19 costs in the general fund as a sub-object or project code or in a separate special revenue fund.

- Capture time and effort information. Your staff’s time and effort during this period will be a key source of information for subsequent reimbursement. Ensure that your district’s method of time entry captures all the required time and effort information in order to ease any future burden. Additionally, activity logs should be kept at each of the district’s facilities in order to monitor employees and visitors entering the premises and to assist in identifying activities for reimbursement. These activity logs could also be useful in determining cleaning requirements prior to reopening facilities for use or notification to those who may be exposed to the virus.

- Follow purchasing policies and procedures. You may need to commit to future contracts and purchases before funding becomes available. Make sure you comply with federal, state and local requirements so that these purchases will be eligible for reimbursement in the future.

The future is uncertain. But by following these guidelines, your district should be better prepared for whatever lies ahead. Weaver can help you review your systems and evaluate funding opportunities that may be appropriate for your district. If you need additional assistance, contact us.

Weaver has created an online Resilience and Recovery Center, where they are posting a variety of content helpful to school districts at this time. This includes information on business continuity and from the Texas Workforce Commission unemployment benefits changes.